Simpl Repayments Redesign

Driving Financial Health: Engineering a Zero-Friction Repayment Experience for Loyal Customers

Overview & Impact.

Team

Product Designer: Smriti

Product Manager: Sumit Chaudhary

Mentor: Raviteja Bandila

Duration

03 Months (August 2022 - October 2023)

Tools

Figma, Collaboration, Creativity and a whole lot of planning.

Design and Strategy

Our Design and Strategy focused on creating an invisible, proactive repayment experience that leverages behavioral science and intuitive UX patterns to maximize authorization rates at the source. The core strategy was to shift from a reactive, cost-intensive recovery model to a predictive, user-centric success model, ensuring the necessary funds are secured smoothly, thus directly improving the Repayment Success Rate while dramatically lowering operational overhead.

Impact

Redesigned repayments experience of Simpl, which improved repayments success rate by 5% and decreased repayment cost to 37bps 50L/mo at 100% rollout. The revamp project marked a significant milestone for me as it was my first major assignment. Working in the fintech industry introduced me to new terminologies, which were quite difficult for me to get the hang of it in the first go. But my teammates, including developers and the product manager, were incredibly kind, helpful, and patient with me throughout the process.

Discover.

Understanding business context

The problem is driven by two critical business metrics: Repayment Cost and Repayment Success Rate. The existing repayment flow is inefficient, failing to steer customers toward lowest-cost, highest-success payment channel for the business.

Primary Business Goal

To Improve the repayment success rate and decrease the repayment cost through redesigning repayment experience.

Initial User Problem Statement

The operational inefficiency translates directly into a high-friction user problem

“"The existing repayment experience is unreliable and confusing. By prioritizing inefficient or failing payment methods, the flow causes repeated transaction failures, high cognitive load, and leads to excessive user frustration and an unacceptable drop-off rate."

Target Audience

Existing Simpl customers, particularly those who make repeat payments and those who currently use expensive or low-success payment methods (Card/Net Banking/UPI Collect).

Understanding KPIs

Significantly Increase the ratio of UPI Intent Payments to UPI Collect Payments.

Achieve an Overall Success Rate increase in UPI transactions.

Decrease Repayment Cost by reducing the percentage of Card/NB transactions.

Reduce Drop Offs from the Repayment Page (as measured by the Clevertap "Close" event).

Define.

User Interview Insights

We interviewed 5 users on google meet who had attempted repayment at least two times in one month time span. The goal was to understand the reason behind their drop off or aftermath of repayment failure.

1

2

3

4

Forced Failure and Frustration

Impact: User feel frustrated due to failures and in cases where they miss repayment deadlines, they feel forced to pay late fee.

"The app consistently pushed me towards an unreliable payment option by placing it first, even when it was experiencing downtime.”

“I experienced frustrating, repeated payment failures, wasting my time and eroding my trust in the app’s reliability."

Decision Paralysis from Dual CTAs

Impact: User feel confused due to dual CTAs present.

"When I reached the final step, the presence of two equally prominent buttons confused me.”

“I didn't know which button was the right path for a successful payment, leading to unnecessary hesitation."

Being Treated Like a Stranger

Impact: User feels the repayment experience is slow and inefficient.

"As a loyal, repeat customer, I expected a personalized, one-click experience. Instead, the generic page forced me to re-select options and methods, which felt slow and inefficient—the app didn't remember me."

High Cognitive Load & Uncertainty

Impact: User drop-offs to go back and recheck payment amount.

"I don't know exactly what I owe, and when it’s due, the second I land on the page. I have to hunt critical numbers and information.

This creates a doubt about making the correct payment."

User Persona

The prompt Player

Bio 📋

Age: 32 years

Location: Urban Metro

Business: IT professional

Priya is an avid Simpl user who values the one-tap payment experience on platforms like Zomato and Blinkit for its time-saving convenience in her busy life. Simpl also provides a helpful buffer when her salary is credited late.

Frustrations 🤺

As a loyal user, she is frustrated by three high-stakes issues:

The lack of clear amount/due date causes uncertainty and drop-off.

The app repeatedly suggests failing methods (UPI Collect), leading to wasted time and multiple failures.

The compounding risk of missing the due date and incurring late fees due to these repeated technical hassles.

Goal 🎯

Speed and Reliability.

She wants to clear her bill in under 30 seconds and confirm the payment worked on the first try.

Motivation ✨

Financial growth and stability.

Achieving timely repayments to avoid late fees.

Steadily increase her Simpl limit over time.

User Journey Mapping

Entry

Review

Selection

Confirmation

Exit

Lack of Clarity

High cognitive load

Failure of selection

Decision paralysis

Abandonment

Neutral

Confused

Anxious

Stuck

Frustated

UX Audit

Inconsistent UI

Elements like payment method tiles, loaders, and disabled states show visual variations across different parts of the existing app, leading to technical debt and user confusion about various interactions.

Lack of Trust

The app marks one method as 'recommended,' but there’s no quick explanation or rationale for why it's the best option.

Difficulty in A/B Testing

The current rigid, monolithic page structure makes it difficult and time-consuming for engineering to isolate and test single variables across different customer cohorts.

Competitive Benchmarking

Recommendation

Earnings/ Offerings

Bill Details

Trust Markers

Affirm

PayPal

Paytm

PhonePe

Amazon

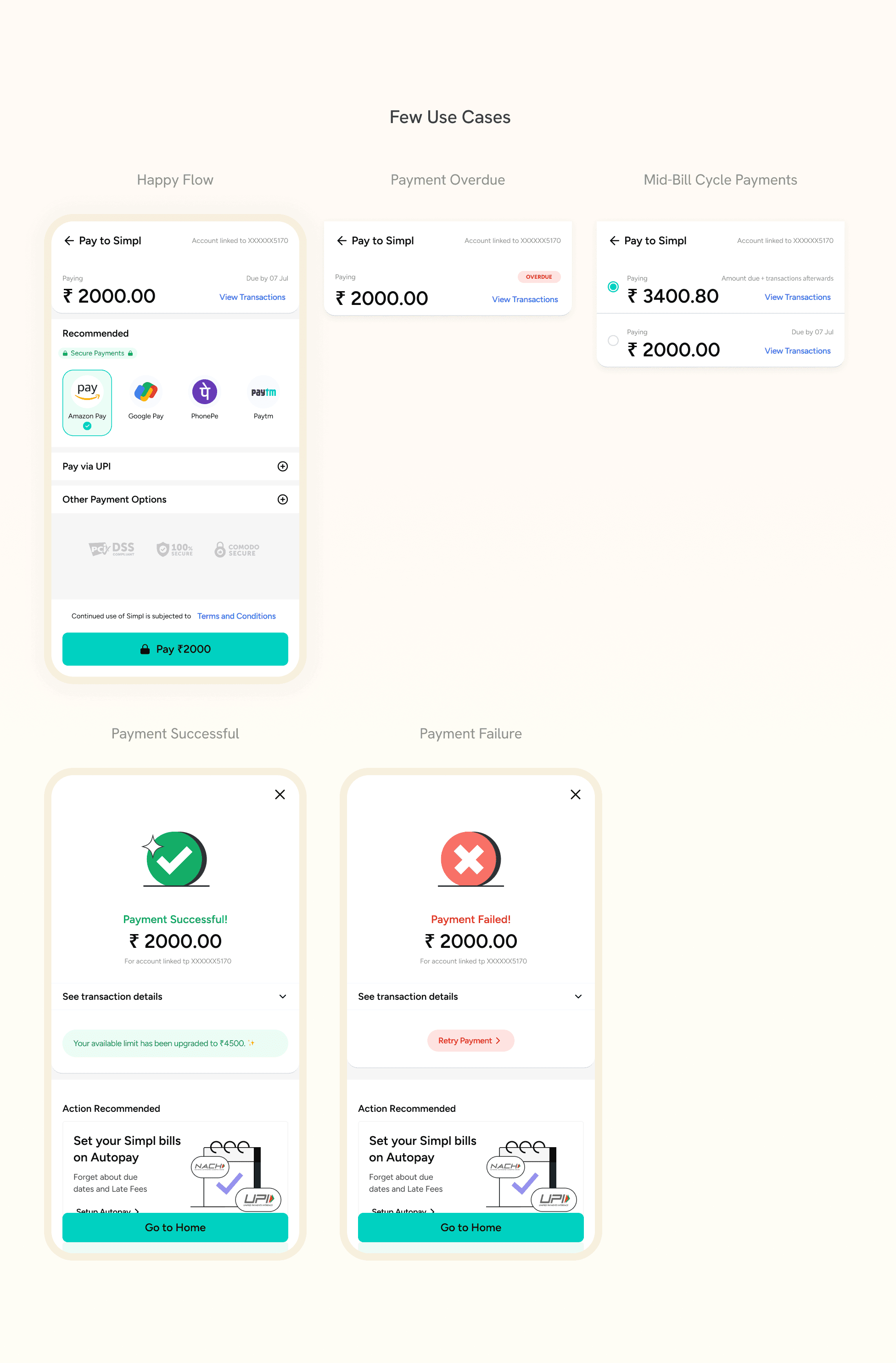

Design and Deliver.

MoSCoW Prioritisation

In order to streamline the journey from page load to payment completion by reducing the number of choices presented initially, while still providing necessary fallback options, I used MoSCoW prioritization to prioritize features.

Must Haves

Must ensure the Amount and Due Date are primary, compliance requirements are met and higher success rate - payment options presented first to user.

Should Haves

Easy configurable design, consistent UI, Visual Heirarchy reinforcing a trust in users mind.

Could Haves

Any additional features like enhanced transaction history, Outage API to be prioritized if need be.

Redesign Information Architecture

We conducted a closed card sorting session with a cohort of active Simpl users in Bengaluru Urban. The participants were asked to organize the various payment options, details, and actions into logical groups. These were the four major groups that came up in the card sorting session.

Paymnt Summary

Outstanding Amount, Due Date

Recommended

Saved and Higher repayment success rate options

UPIs

Saved UPI IDs, UPI apps, Add new ID

Other Options

Saved Cards, New Card, Net Banking

Final Design

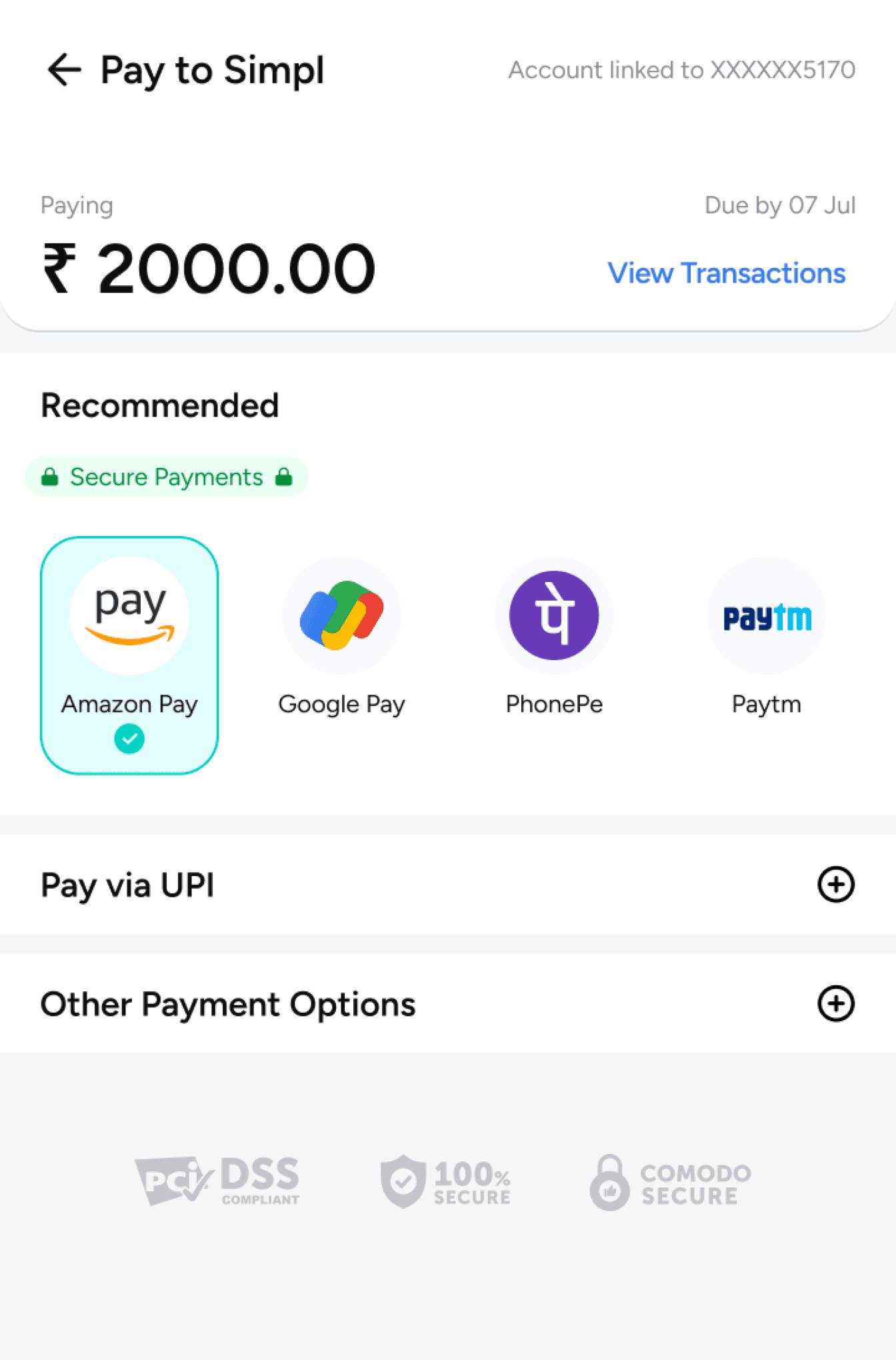

Pay to Simpl

Account linked to XXXXXX5170

Paying

Due by 07 Jul

₹ 2000.00

View Transactions

Amount being paid

Assurance of paying to the right account

Secondary CTA for user who wishes to see transactions

Payment Card with Navigation Header

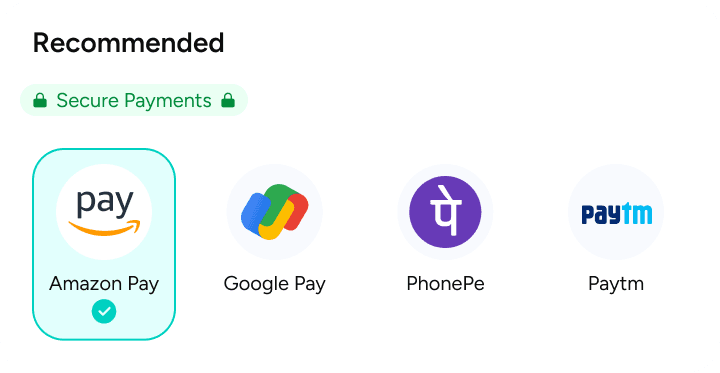

Recommended

Secure Payments

Amazon Pay

Google Pay

PhonePe

Paytm

Show payment option which has success rate > 70%

Recommended Payment Options Card

Last used payment option

by user( either UPI or Card)

Trust Marker

UPI Intent app in user’s device

Saved UPI Intent app (either last used intent option or intent option respective to collect id)

Pay via UPI

UPI ID

UPI Apps

Google Pay

PhonePe

View all UPI apps

Pay via UPI

UPI ID

a******@okhdfcbank

Enter your UPI ID

Enter your lorem ipsum here

UPI Apps

Other Payment Options

Card Payment

HDFC MasterCard XXXX 5544

DELETE

Add new card

Note: Prepaid cards such as food cards, meal cards, wallet cards are not accepted.

Enter your card number

Valid through MM/YY

CVV

Name on card

Secure your card with Visa

Know More

Net Banking

Other Payment Options

Card Payment

Net Banking

Please select your bank

You will be redirected to your bank’s login page

HDFC

SBI

ICICI

View all banks

Other Payment Options Card

UPI ID Payment Option

Net Banking Payment Option

UPI App Payment Option

Card Payment Option

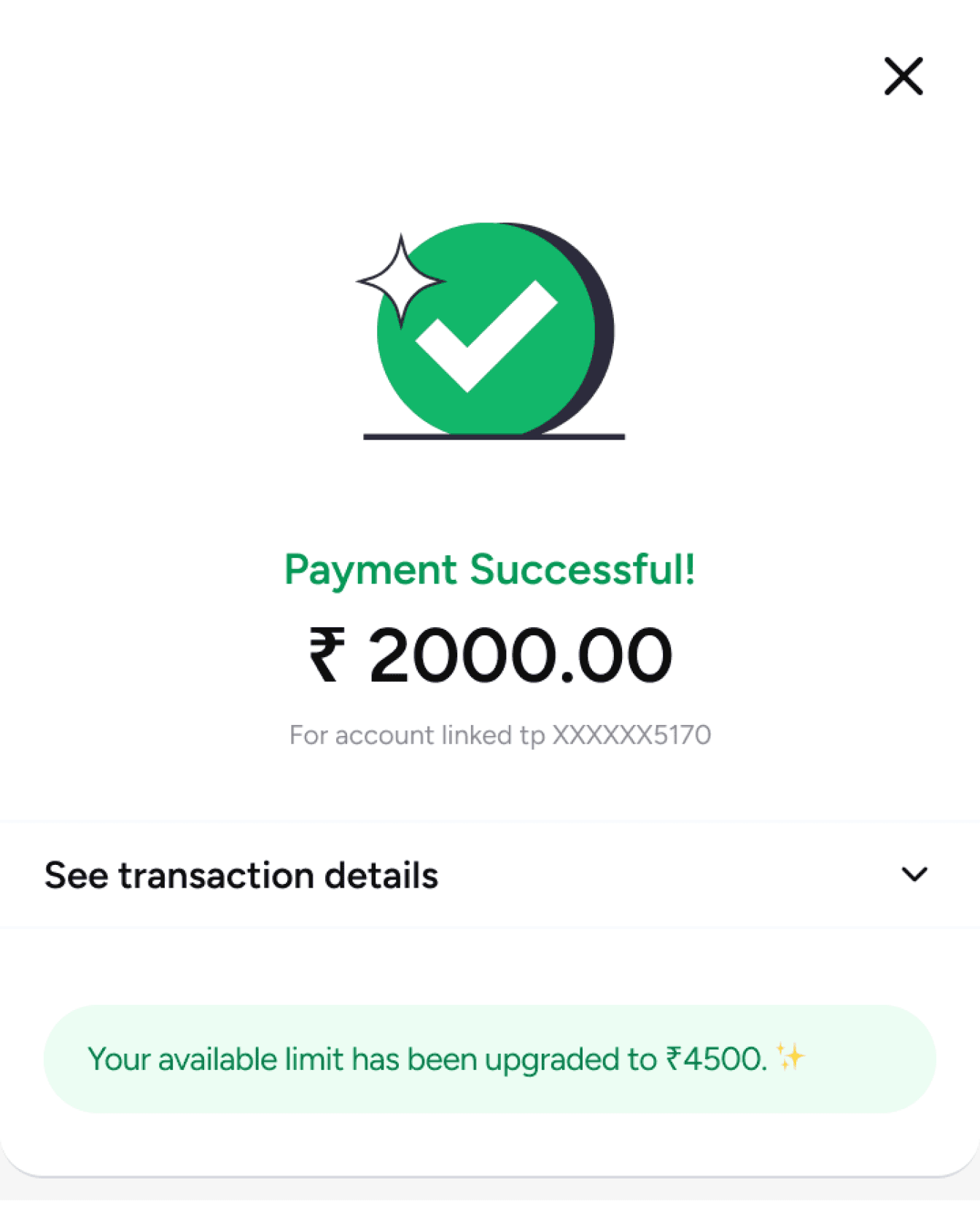

We launched a V0 version of new architecture to 10% users, which helped us test the new designs as well we saw significant improvement in success rate as well as decrease in repayment cost. Below are the screen recordings of actual working product.

Design System

Post, launch of V0, we identified that many use cases as well as visual inconsistencies can be handled well if we incorporate a design system. I developed a dedicated design system specifically for the Repayments experience. This strategic move guaranteed visual consistency and a unified user flow across all channels (web, mobile, and in-app). Crucially, by establishing these reusable components and clear guidelines, we drastically reduced future design debt and created a foundation that empowers future designers to iterate rapidly and maintain brand fidelity. You can check it here.

See Design System

Content

View more work related case studies?

Explore all narratives

Let’s build

meaningful stuff together.

Made with curiosity, care and kindness. 🙌

In collaboration with GenAI 😉